News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Pledges to Safeguard Crude Oil Transport; Oil Prices Surge and Pull Back; Gold and Silver Plunge as Dollar Strengthens (March 04, 2026)2Locals prefer satoshis to dollars, says Africa Bitcoin chair Stafford Masie3'No longer a choice': Bitwise CIO says US-Iran strikes put crypto in primary market role

Microsoft, Starlink Join Forces To Close Global Digital Divide With Orbital AI Access

Finviz·2026/02/24 17:36

Baker Hughes (BKR) Up 13.1% Since Last Earnings Report: Can It Continue?

Finviz·2026/02/24 17:33

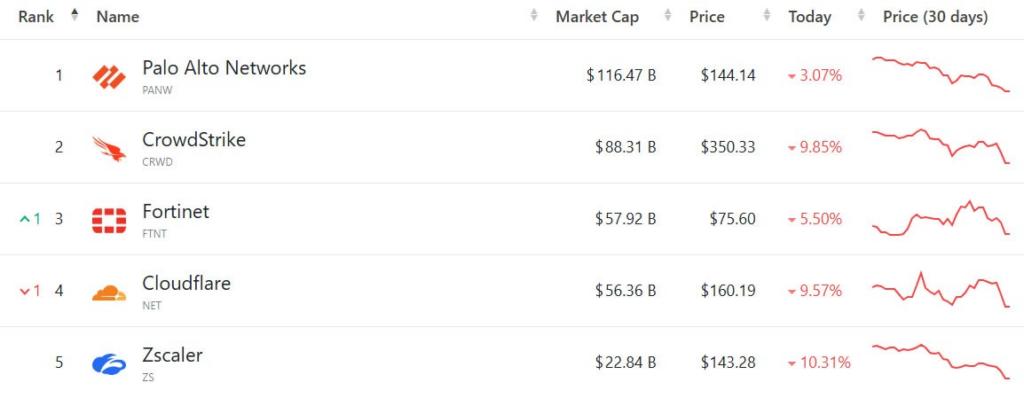

Cybersecurity stocks fall after Claude Code Security presentation

Cointribune·2026/02/24 17:27

Tapestry Stock Surges 85% in a Year: Should You Book Profit?

Finviz·2026/02/24 17:27

IonQ's Quantum Roadmap and Foundry Strategy Through 2030

Finviz·2026/02/24 17:27

PAAS Delivers Record Revenues in 2025: Can the Rally Continue?

Finviz·2026/02/24 17:27

CMC vs. CRS: Which Steel Stock Is the Better Buy Right Now?

Finviz·2026/02/24 17:18

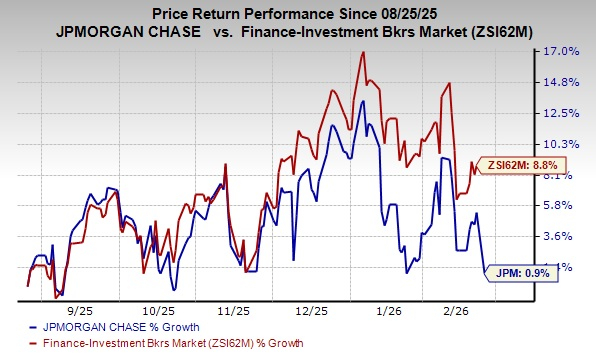

JPM Signals IB Strength, NII Growth & Tech Spending Jump in 2026

Finviz·2026/02/24 17:18

Made In Texas: Why Apple Is Moving Mac Mini Production To Houston

Finviz·2026/02/24 17:15

DeFi Leaders Uniswap, Aave, and Chainlink Drive Institutional Momentum in February 2026

BlockchainReporter·2026/02/24 17:15

Flash

19:19

The European Union has streamlined the list of companies from France, Sweden, and the United Kingdom for the management of its established Scaleup Europe Fund program.The European Commission will be one of the founding investors of this project, with private investors and pension funds also participating. The project aims to raise 25 billion euros, focusing on strategic technology and companies.

19:10

According to sources, the US Department of Justice is conducting an antitrust investigation into the global fertilizer industry, involving several international giants.The companies currently listed for review include Canadian fertilizer producer Nutrien Ltd, US-based Mosaic Co, CF Industries Holdings Inc, Koch Inc, and Norway's Yara International. The investigation focuses on whether fertilizer manufacturers have engaged in market price manipulation. It is noteworthy that the five named companies are all major players in the global fertilizer market, with businesses covering key fertilizer categories such as nitrogen, phosphate, and potash. Industry insiders analyze that this investigation may impact the structure of the global fertilizer supply chain. As it is currently a critical period for spring fertilizer preparation, regulatory developments have attracted significant attention from the capital markets. The stock prices of the relevant companies showed noticeable fluctuations after the news was released.

19:10

Federal Reserve Beige Book: Most districts expect slight and moderate economic growthAlthough overall consumer spending has slightly increased, two districts reported continued declines in spending. Many districts noted that sales were suppressed due to rising economic uncertainty, increased price sensitivity, and low-income consumers cutting back on expenditures. Districts affected by winter storms indicated that retail foot traffic generally slowed; additionally, one district mentioned that immigration enforcement activities had a negative impact on customer demand in urban areas. Among districts providing relevant reports, automobile sales mostly declined, with many districts attributing this to ongoing affordability issues. Expand

News