News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Pledges to Safeguard Crude Oil Transport; Oil Prices Surge and Pull Back; Gold and Silver Plunge as Dollar Strengthens (March 04, 2026)2Locals prefer satoshis to dollars, says Africa Bitcoin chair Stafford Masie3'No longer a choice': Bitwise CIO says US-Iran strikes put crypto in primary market role

DeepSnitch AI Bonus Is Eating XRP and ADA Alive in the Reward Structure Game Right Now

BlockchainReporter·2026/02/24 17:12

Why First Watch (FWRG) Shares Are Plunging Today

Finviz·2026/02/24 17:12

Coherent vs. UiPath: Which AI Growth Stock Is the Better Buy?

Finviz·2026/02/24 17:12

Amer Sports Stock Falls On Cautious Outlook

Finviz·2026/02/24 17:12

Why Are Teradata (TDC) Shares Soaring Today

Finviz·2026/02/24 17:12

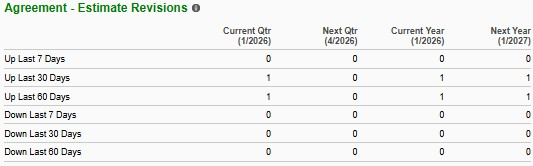

As Nvidia Goes, So Goes Wall Street

Finviz·2026/02/24 17:09

Portillo's Inc. (PTLO) Q4 Earnings and Revenues Beat Estimates

Finviz·2026/02/24 17:03

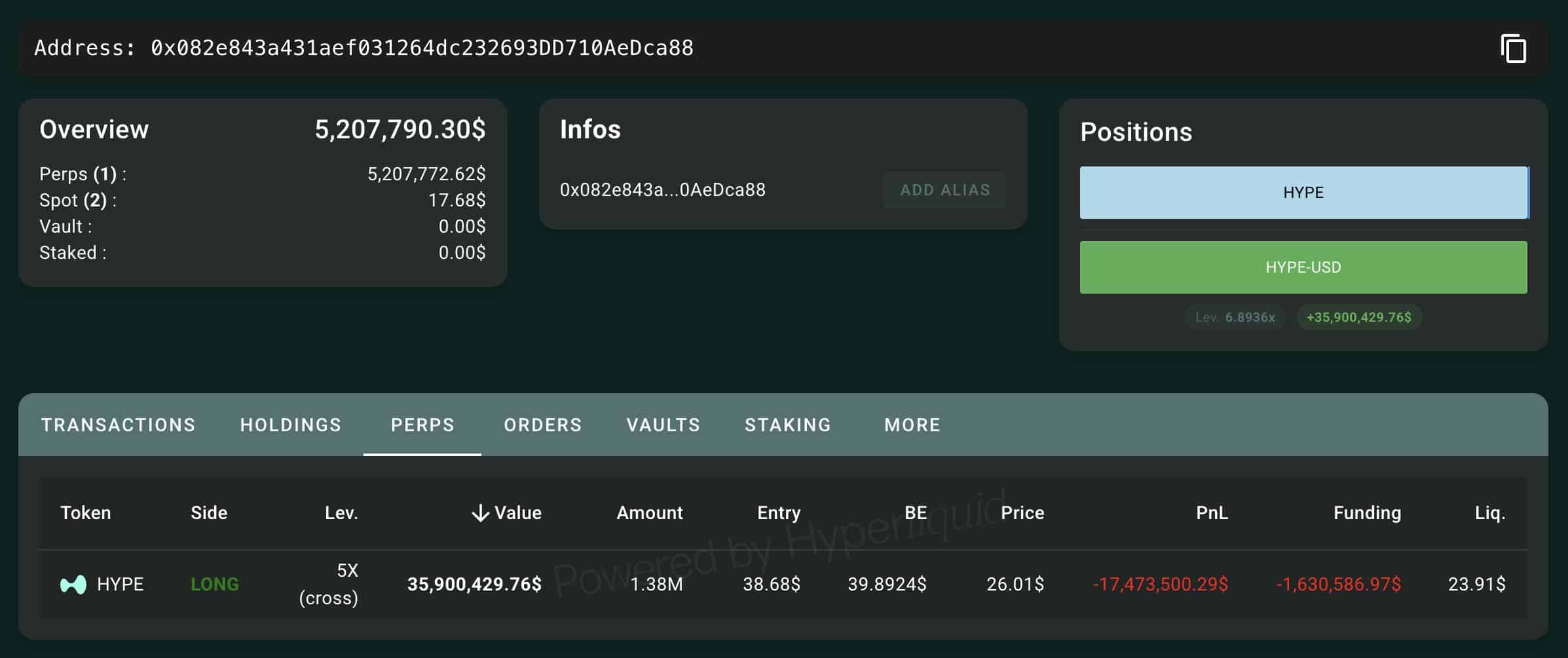

Hyperliquid whale battles $17mln loss as HYPE drops to $26 – Details!

AMBCrypto·2026/02/24 17:00

Gold experiences profit-taking, while silver rises amid volatile trading

101 finance·2026/02/24 17:00

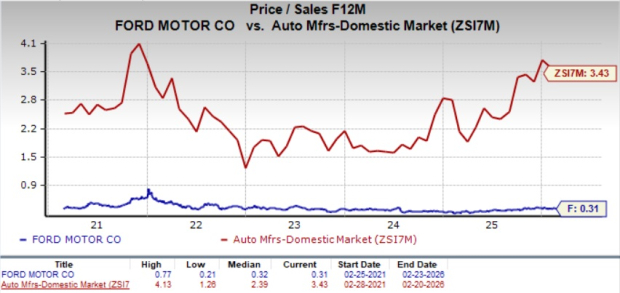

Is Ford on Track to Achieve Its Adjusted EBIT Target by 2029?

Finviz·2026/02/24 16:57

Flash

02:11

Goldman Sachs: Recent Risk Asset Pullback is a Buying Opportunity, Not the Start of a Long-term Bear MarketBlockBeats News, March 5th, according to Wall Street News, amid global market turbulence, Goldman Sachs goes against the trend and believes that the recent market pullback is a buying opportunity rather than the beginning of a long-term bear market, behind this is the firm's optimistic expectation for the "four-week recovery" of the Strait of Hormuz circulation.

Goldman Sachs' strategy team, led by Peter Oppenheimer, wrote in a report on Wednesday that although risk assets are facing "significant resistance" from concerns arising from the Middle East conflict and AI disruptive impact, the resilience of economic fundamentals and strong corporate profit growth mean that the depth and duration of this pullback will be limited.

Goldman's optimism about the global market is largely based on the expectation of a rapid recovery in the energy supply chain. Goldman's Chief Oil Strategist, Daan Struyven, expects that blocked oil shipments in the Strait of Hormuz will remain at the current extremely low level in the next 5 days, then recover to 70% of normal volumes within two weeks, and achieve 100% full normalization in four weeks.

02:09

an exchange Analyst: Brown Paper Reveals Wait-and-See Attitude, Iran Conflict Disagreement Intensifies, BTC Bounce High Liquidity StandoffBlockBeats News, March 5th. On the eve of the Fed's March interest rate meeting, the latest "Beige Book" was released, summarizing the results of a survey of all 12 Federal Reserve districts as of February 23. The report indicates that while the data shows stabilization, both businesses and consumers remain cautious, the momentum of job expansion has slowed down, and inflation pressure remains sticky. It is worth noting that the report does not fully reflect the subsequent effects of the Supreme Court overturning part of the tariff policy and the escalation of the Middle East conflict.

Specifically, observations show that the hiring market is becoming more conservative, with most companies delaying expansion plans; inventory strategies are shifting towards "just-in-time ordering." In some regions, labor and consumption are simultaneously under pressure due to immigration enforcement. On the pricing front, insurance, energy, and raw material costs continue to be passed on to the end consumer, leading to a "shrinkflation" effect. Overall, the economy is not in a recession, but the intertwined growth momentum and policy uncertainties are evident.

Meanwhile, a procedural Senate vote in the United States failed to stop Trump's ongoing military actions against Iran, keeping the costs of conflict and energy shocks as uncertainties. The market is repricing risk assets amid high oil prices and expectations of high-interest rates.

Turning to the crypto market, the price of BTC rapidly surged from around $66,000 to $74,000 and then retraced, in a typical liquidity sweep. The $74,000 range is seeing a gathering of short liquidation orders; long leverage liquidation points are concentrated around $70,000, while there is still secondary liquidity near $64,000.

In conclusion, macro-level uncertainties are increasing, and in the short term, BTC's structure continues to be dominated by liquidity battles within a range. The key focus remains on whether high-level short positions will be further squeezed and transformed into trend momentum.

02:09

Aave Labs Releases Aave V4 Security Roadmap Full Transparency Audit ReportBlockBeats News, March 5th, according to official sources, Aave Labs released a full transparency report on the Aave V4 Security Plan, including aspects such as methodology, process, and outcomes, with endorsements from multiple security firms such as Trail of Bits, Blackthorn, Certora, among others. Through manual audits, formal verification, invariant testing, fuzz testing, and public security competitions, a total of about 345 days of security review has been conducted. This plan is supported by a $1.5 million dedicated security budget approved by the DAO.

Aave Labs announced that they will continue five core commitments from the Aave V4 Security Plan: embedding formal verification in the early stages of development to ensure that the architectural design is guided by secure methods rather than just validation; adopting a layered security approach, including manual audits, formal verification, invariant testing, AI-assisted checks, fuzz testing, and public security competitions, to cover more potential vulnerabilities; maintaining ongoing security coverage, where the formal verification framework and invariant testing suite will continue to operate with protocol iterations; establishing a long-term bug bounty program to leverage a broader security community for continuous monitoring; and optimizing AI scanning capabilities to continually enhance the intelligent security detection levels of future versions based on existing testing experience.

News