News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

How Tether’s Interest Rate Engine Is Starting to Stall

Tipranks·2026/02/24 01:30

MYX Finance (MYX) Price Drops 25%—Will the Upcoming ‘Death Cross’ Cause a 35% Crash Ahead?

Coinpedia·2026/02/24 01:30

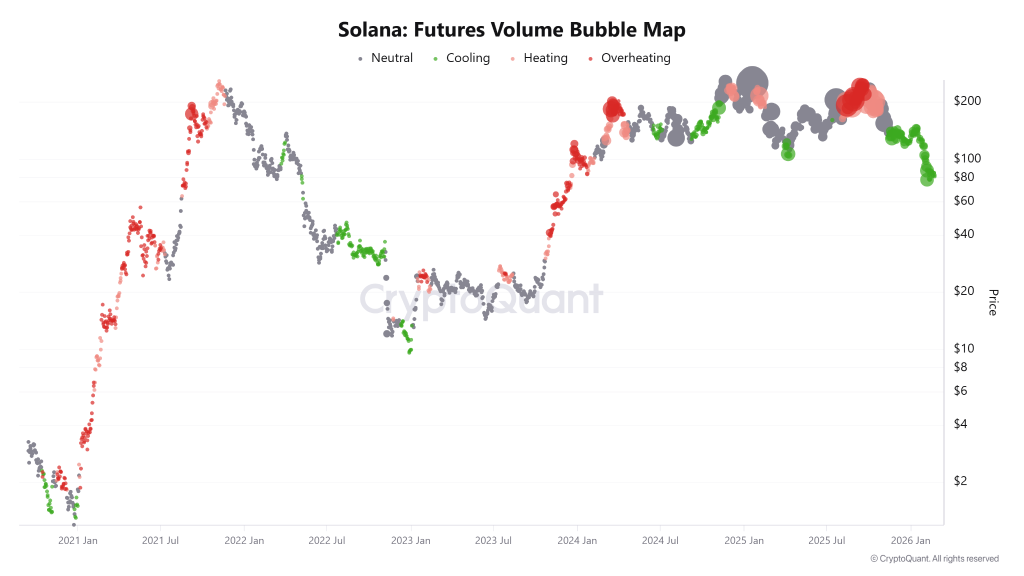

Solana Price Cools Off, But Whales Load Up for a Rebound?

Coinpedia·2026/02/24 01:30

Market Crashes, But This Altcoin Rallies Towards a New ATH; Are Low-Caps the Next Safe Haven?

Coinpedia·2026/02/24 01:30

Crypto Bloodbath Today: Why Altcoins, Bitcoin Collapsed and What Comes Next

Coinpedia·2026/02/24 01:30

Ryman Hospitality Properties (RHP) Q4 FFO and Revenues Beat Estimates

Finviz·2026/02/24 01:27

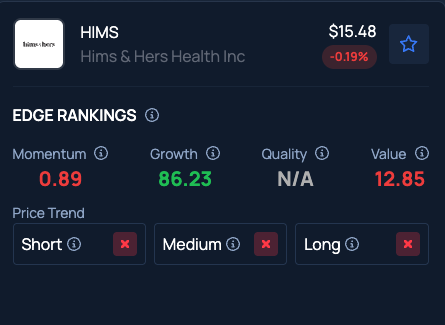

Hims & Hers Health, Inc. (HIMS) Surpasses Q4 Earnings Estimates

Finviz·2026/02/24 01:27

Claritev Corporation (CTEV) Reports Q4 Loss, Tops Revenue Estimates

Finviz·2026/02/24 01:27

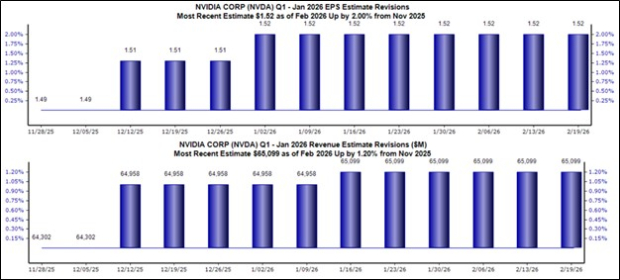

NVIDIA Earnings Loom: What Do Estimates Say?

Finviz·2026/02/24 01:21

Flash

18:35

Activist investment firm Land & Buildings recently issued a public call to the board of First Industrial, urging them to take decisive action.The institution proposed that if the company fails to significantly narrow the discount rate between its share price and net asset value within the next six months, the board should immediately authorize the initiation of a formal evaluation process for strategic alternatives. Such evaluations typically include options that may enhance shareholder value, such as asset sales, company mergers, or privatization.

18:35

Investment firm Land & Buildings disclosed today that it has officially nominated its founder and Chief Investment Officer as a board candidate, who will participate in the board election at First Industrial Realty Trust (FR)'s 2026 annual shareholders meeting.This move marks the institution's deep involvement in the corporate governance and future strategic direction of the First Industrial Realty Trust.

18:32

Goldman Sachs: Nvidia Reports Strong Earnings but Shares Fall 4.5%Goldman Sachs pointed out that Nvidia's revenue grew by 73% year-on-year, and the company gave an optimistic outlook for its artificial intelligence business. However, its stock price still fell by 4.5%, dragging down the semiconductor sector and the S&P 500 index. Analysts believe this reflects a "sell the news" trend, profit-taking, and concerns about the sustainability of AI capital expenditures by hyperscale cloud service providers. AI spending is expected to grow by 62% in 2026, lower than the 73% in 2025, but supply-demand imbalances and strong balance sheets may still push expectations higher. Current data center demand and memory bottlenecks provide support for Nvidia, and the market is focusing on whether capital expenditures will peak in 2027.

News