News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Bitcoin Faces Fourth Straight Monthly Decline as Historical Patterns Reemerge

Cointurk·2026/02/23 23:33

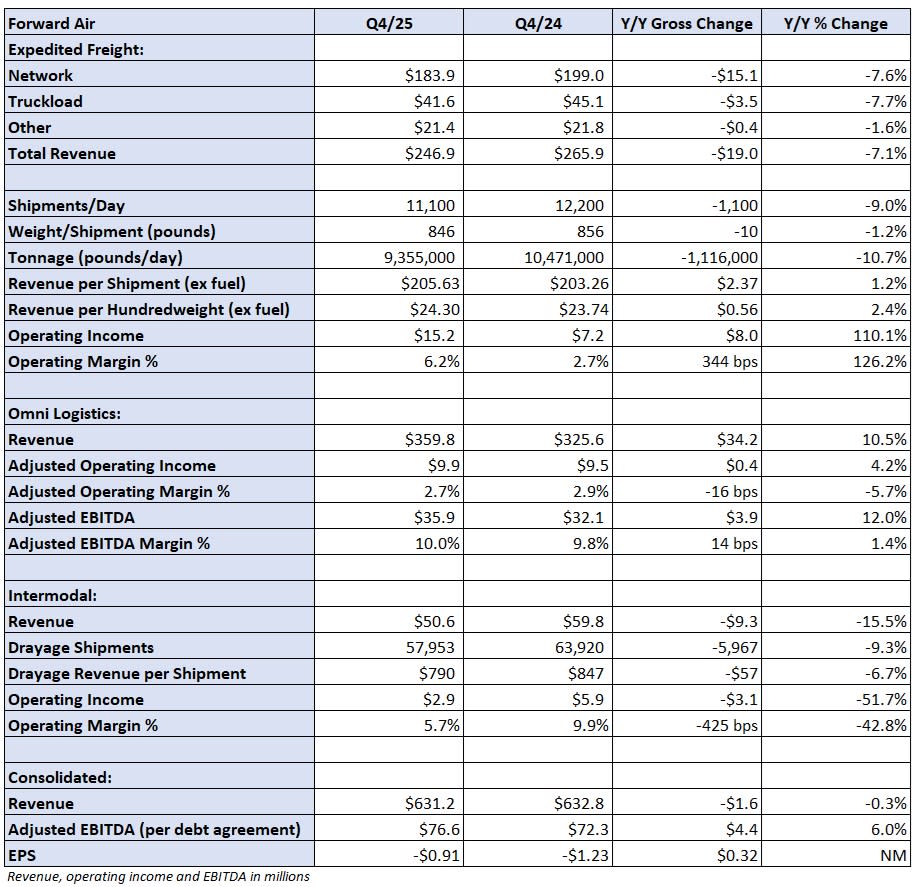

Forward Air states that its strategic review is close to completion

101 finance·2026/02/23 23:18

Implied Volatility Surging for Kirby Stock Options

Finviz·2026/02/23 22:57

Offshore entity takes $436M Blackrock IBIT stake

Grafa·2026/02/23 22:45

Tesla Sues California DMV, Seeks to Overturn Ruling on False Advertising of FSD

新浪财经·2026/02/23 22:38

Crypto Exchange Backpack Plans to Offer Company Equity to Token Stakers

101 finance·2026/02/23 22:36

Dragonfly’s Qureshi says crypto built for AI

Grafa·2026/02/23 22:33

Anthony Pompliano's Bitcoin Treasury ProCap Buys Back Stock Amid 85% Price Plunge

Decrypt·2026/02/23 22:29

Ryman Hospitality Properties: Fourth Quarter Earnings Overview

101 finance·2026/02/23 22:21

JBT: Q4 Financial Results Overview

101 finance·2026/02/23 22:21

Flash

19:35

WTI April crude oil futures closed down $0.21, or 0.32%, at $65.21 per barrel.NYMEX March natural gas futures closed at $2.8270 per million British thermal units. NYMEX March gasoline futures closed at $2.0323 per gallon, and NYMEX March heating oil futures closed at $2.6125 per gallon.

19:06

CSX Corp announces its latest quarterly dividend plan, with a payout of $0.14 per share, representing an 8% increase from the previous dividend of $0.13 per share.This adjustment highlights the company's robust cash flow management and commitment to shareholder returns, while also reflecting management's optimistic outlook for future business prospects. Dividend growth is often regarded as an important indicator of a company's financial health. Against the backdrop of current macroeconomic volatility, CSX Transportation is instilling confidence by increasing its dividend, which may attract more long-term value investors. It is worth noting that this dividend adjustment echoes the company's recently announced freight volume growth data, suggesting that its core business continues to generate strong earnings momentum. As a North American rail transportation giant, CSX Transportation's dividend increase this time exceeds the industry average. This move not only continues its tradition of consistent dividend payments over the past five years, but also further solidifies its image as a high-dividend company in the infrastructure sector. The market will closely monitor the company's subsequent capital allocation strategies, especially regarding the balance between operational expansion and shareholder returns.

19:00

Grayscale: Blockchain Will Become the Infrastructure for AI TradingJinse Finance reported that as AI triggered a roughly 20% decline in the SP500 software index, Grayscale Head of Research Zach Pandl stated that blockchain and AI technologies are essentially complementary. Pandl pointed out that blockchain can serve as the financial infrastructure for AI intelligent agents, enabling wallet-based, round-the-clock global transactions, and can help mitigate AI risks such as deepfakes and centralized control. Although crypto asset valuations have recently fallen in tandem with software stocks, Pandl believes that in the long term, the two will form a constructive synergy. However, he also cautioned that AI may bring new challenges, including compromised user privacy and smart contract security risks.

News