News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Paramount submits higher offer for Warner Bros Discovery in bid to block Netflix, source says

101 finance·2026/02/23 22:12

Paramount submits higher offer for Warner Bros Discovery in bid to block Netflix, source says

101 finance·2026/02/23 22:09

'Ethereum Foundation believes in Defipunk', says org as it forms team to support protocol development

The Block·2026/02/23 22:03

Tenaris Terminates Second Tranche of its USD 1.2 Billion Share Buyback Program

Finviz·2026/02/23 22:00

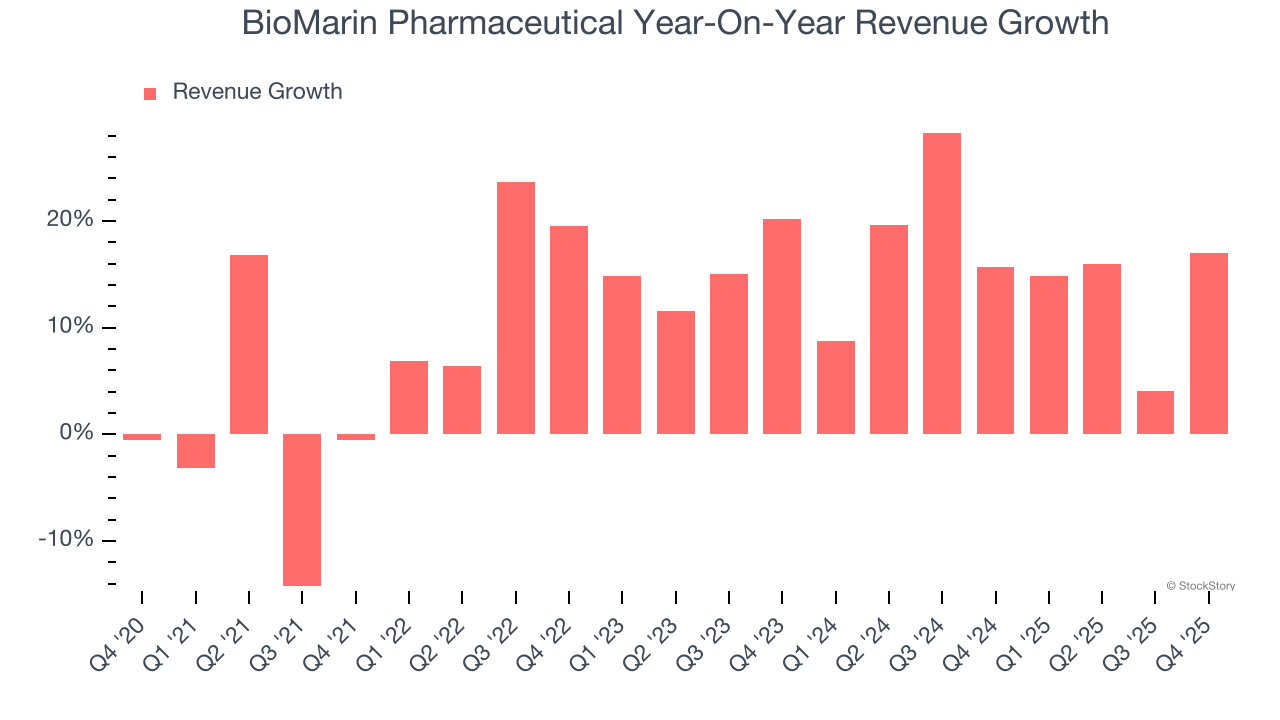

BioMarin Pharmaceutical's (NASDAQ:BMRN) Q4 CY2025 Sales Beat Estimates

Finviz·2026/02/23 21:54

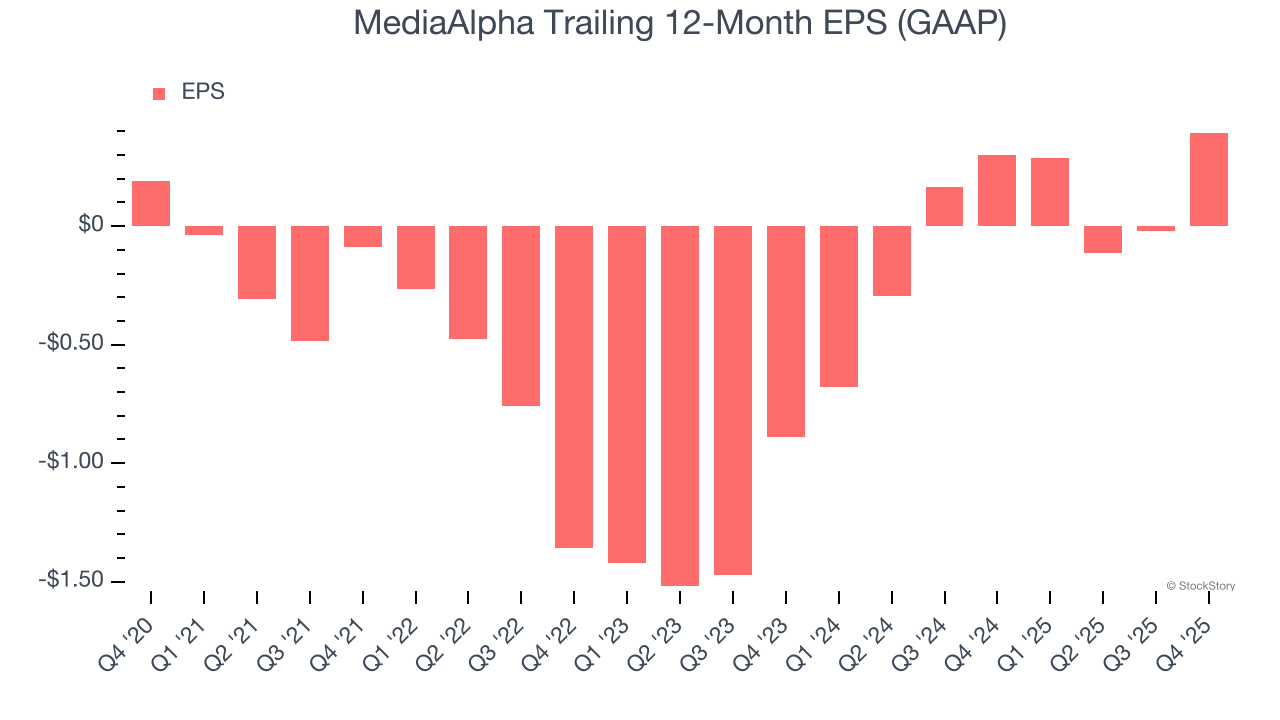

MediaAlpha (NYSE:MAX) Misses Q4 CY2025 Sales Expectations, But Stock Soars 8.2%

Finviz·2026/02/23 21:51

Flash

21:13

Plug Power has reached a definitive agreement worth $132.5 million with Stream Data Centers, marking the launch of the company’s strategic infrastructure optimization plan totaling up to $275 million.This protocol is the first key step in the overall plan, aiming to enhance operational efficiency and strategic synergy by optimizing infrastructure layout.

21:04

The three major U.S. stock indexes closed mixed.The three major U.S. stock indexes closed mixed, with the Nasdaq down 1.18%, the S&P 500 down 0.54%, and the Dow Jones up 0.04%. Nvidia fell more than 5%.

20:56

Grant Cardone plans to tokenize $5 billion worth of company real estate assetsReal estate investor Grant Cardone stated that his company, Cardone Capital, is exploring blockchain-based tokenization methods to manage $5 billion worth of real estate assets. Previously, Cardone Capital had purchased bitcoin and expanded its digital asset portfolio. Although real estate tokenization is developing rapidly, regulatory hurdles and insufficient secondary market liquidity remain major challenges.

News