News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Bitget UEX Daily|Positive Progress in U.S.-Iran Talks; Nvidia Plunges Over 5%; Dell Guidance Beats Expectations (February 27, 2026)

PayPal Stock Up Monday Despite CEO Shake-Up, Takeover Interest, Lowered Outlook

Finviz·2026/02/23 19:36

Here's the Reason Arcellx Stock Has Surged Nearly 80% Today

101 finance·2026/02/23 19:30

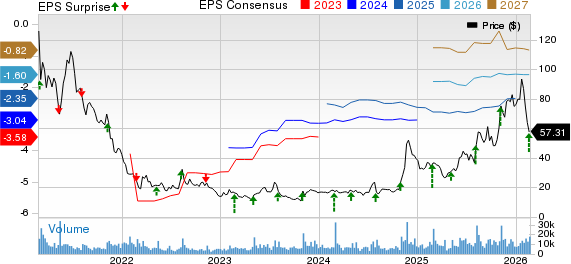

LMND Q4 Loss Narrower Than Expected on Solid Underwriting

Finviz·2026/02/23 19:27

What's Going On With Uber Stock On Monday?

Finviz·2026/02/23 19:24

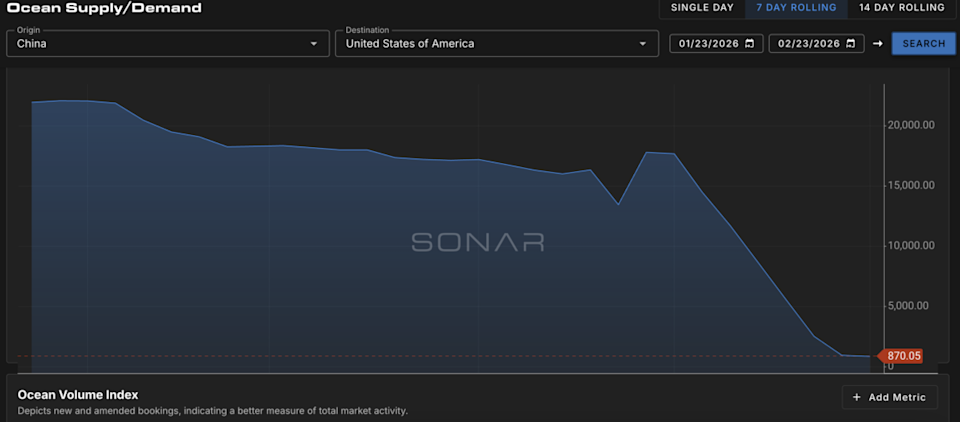

“Textbook” example: Reasons behind the ongoing decline in trans-Pacific container shipping rates

101 finance·2026/02/23 19:15

Why Nike (NKE) Shares Are Down Today

101 finance·2026/02/23 19:15

DraftKings Investor Day: Analyst Sees TAM Growth Potential, Eyes FY28 Forecast Updates

Finviz·2026/02/23 19:12

Array's Q4 Earnings Surpass Estimates on Higher Revenues

Finviz·2026/02/23 19:12

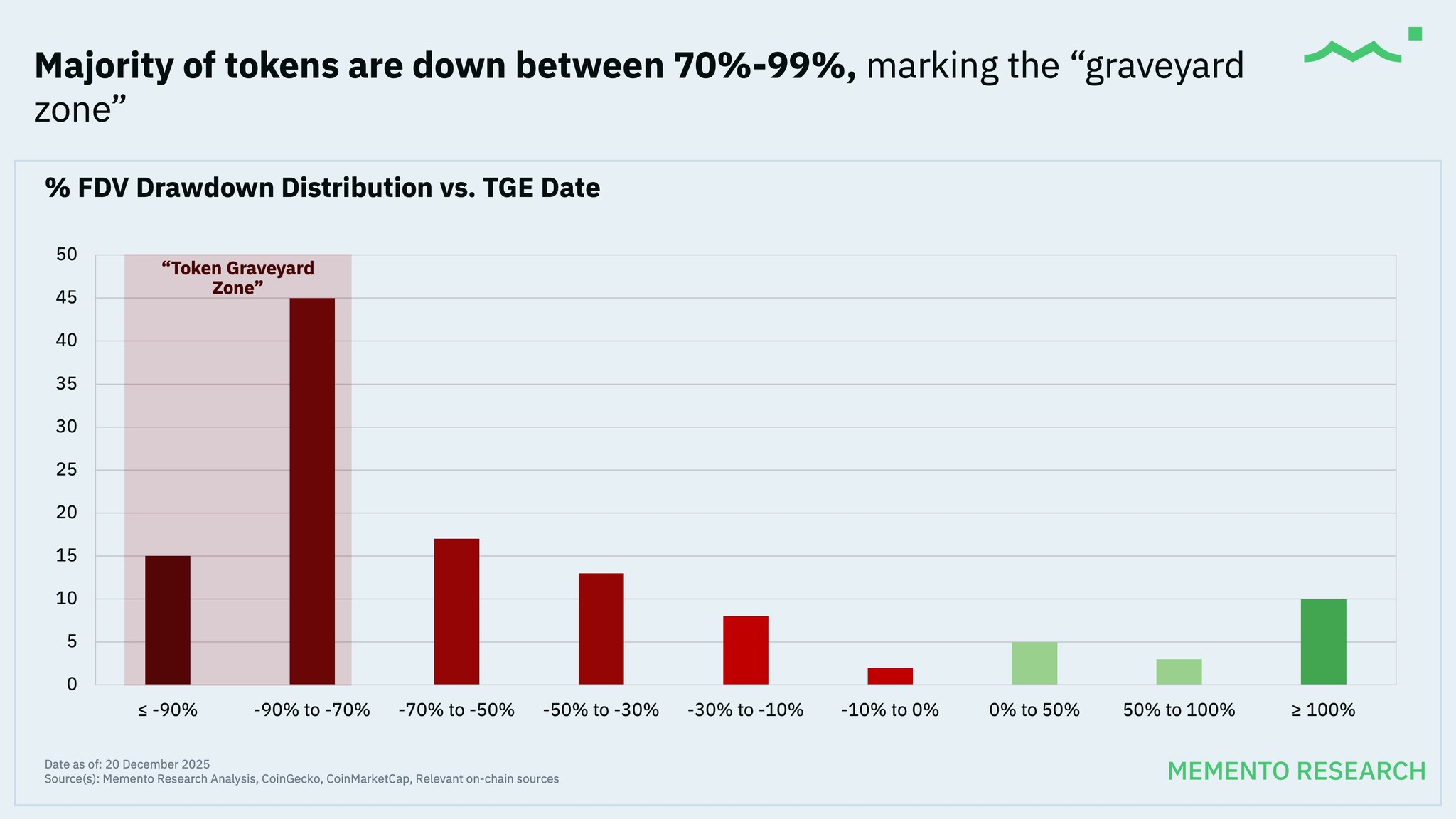

Crypto: Capital Diverts from Tokens to Stocks

Cointribune·2026/02/23 19:09

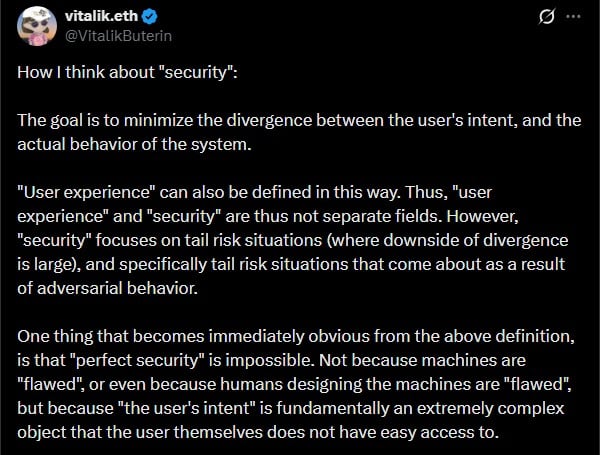

Vitalik Buterin is trying to fix crypto’s biggest blind spot: ‘The goal is to…’

AMBCrypto·2026/02/23 19:03

Flash

09:33

Opinion reminds users to set their OPN airdrop allocation address before 7:59 AM (UTC+8) on March 1.Jinse Finance reported that the BSC ecosystem prediction platform Opinion stated that users should set their OPN airdrop allocation address before 7:59 AM (UTC+8) on March 1. The allocation can be set to a maximum of 5 self-custody BNBChain wallet addresses; please do not use deposit addresses from centralized exchanges. If no setting is submitted, the currently connected wallet address will be set as the default receiving address. Once submitted, it cannot be changed (neither the address nor the allocation ratio can be modified). Please double-check carefully to avoid permanent asset loss.

09:31

Bank of America lowers Synopsys target price to $515Glonghui, February 27|BofA Securities has lowered the target price of Synopsys from $560 to $515, while maintaining a "Buy" rating. (Glonghui)

09:29

US Stocks Move|Block Soars Over 22% Pre-market After Announcing Nearly 50% Layoffs and Raising Annual Gross Profit GuidanceGlonghui, February 27|Fintech company Block (XYZ.US) surged 22.6% in pre-market trading, reaching $66.84. According to reports, Block announced a reduction of nearly half its workforce, involving about 4,000 employees, citing an AI-driven efficiency boost as the reason for a comprehensive organizational restructuring. Company CEO Jack Dorsey predicted in a shareholder letter that most companies will be forced to make similar structural adjustments within the next year. In addition, the company’s management raised its full-year performance expectations for 2026, now forecasting gross profit to reach $12.2 billions, representing an 18% year-on-year increase.

News