News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Bitget UEX Daily|Positive Progress in U.S.-Iran Talks; Nvidia Plunges Over 5%; Dell Guidance Beats Expectations (February 27, 2026)

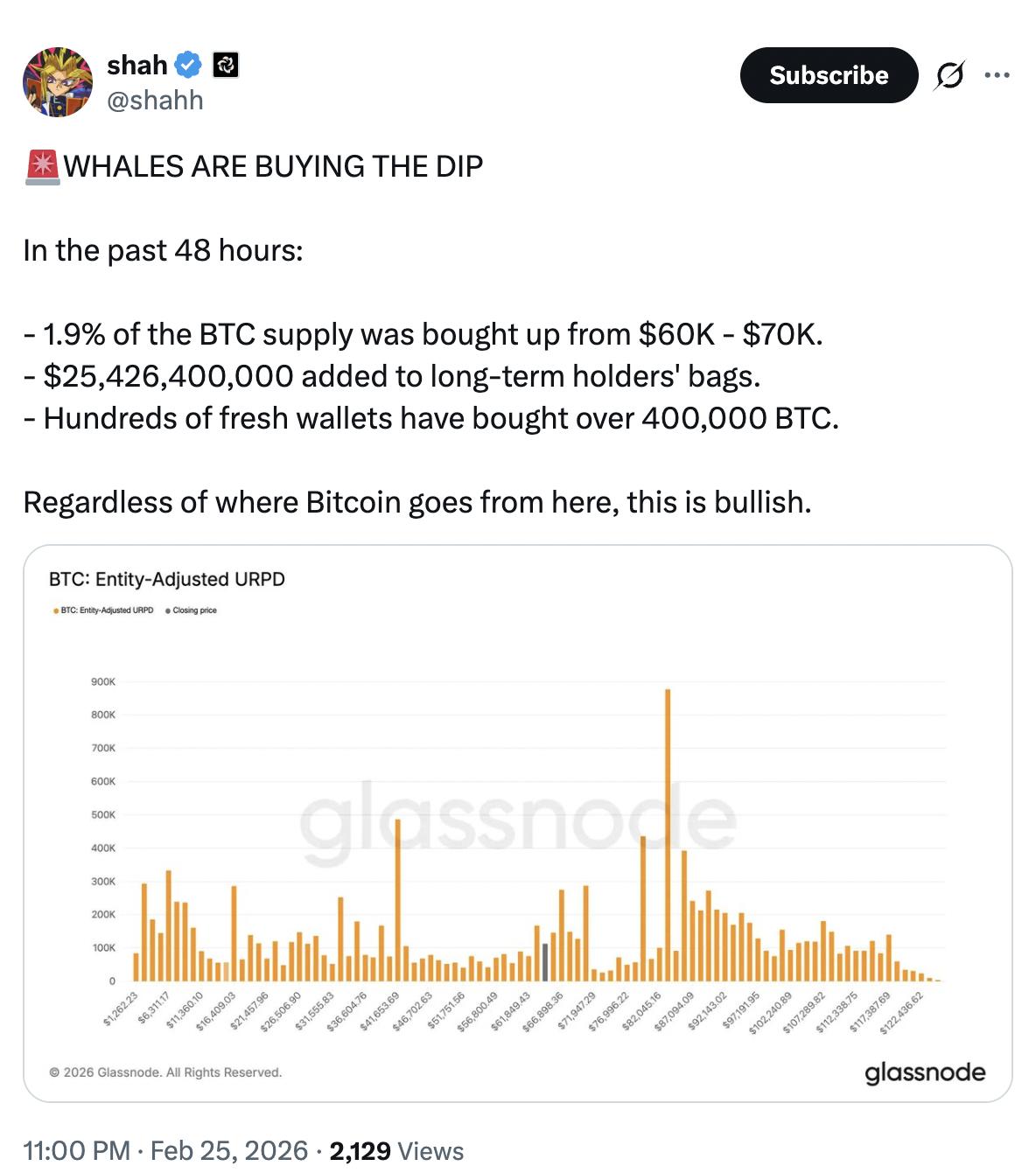

Bitcoin traders explain why $80K is the next target for bulls

Cointelegraph·2026/02/26 11:30

Expectations and Outcomes: Millicom’s Historic Fourth Quarter and the “Buy the Rumor, Sell the News” Phenomenon

101 finance·2026/02/26 11:25

USD: Short-term resilience, long-term weakness – TD Securities

101 finance·2026/02/26 11:24

Aurinia: Fourth Quarter Financial Results Overview

101 finance·2026/02/26 11:24

Bilt's AI Concierge: A $10B+ Gamble on the Future of Network Commerce

101 finance·2026/02/26 11:21

Musk touts California robotaxis but Tesla does nothing to get permits

101 finance·2026/02/26 11:15

Tesla challenges California authorities

101 finance·2026/02/26 11:15

BFLY Q4 Earnings: The Tactical Setup for a Pre-Market Move

101 finance·2026/02/26 11:03

Flash

22:34

According to the latest filing submitted to the U.S. Securities and Exchange Commission (SEC), Trump Media & Technology Group has no plans to announce any dividend distribution scheme in the foreseeable future.This statement implies that investors holding the company's shares may not receive cash dividend returns in the short term.

22:28

Offshore RMB rose about 1.4% in February, once approaching 6.82 yuanOffshore RMB rose by approximately 350 points this week, an increase of 0.50%; in February, it rose by about 950 points, an increase of 1.37%. Overall, it continued to rise, with a trading range of 6.9630-6.8267 yuan. According to Bloomberg data, offshore RMB broke through the 50-month moving average (this technical indicator is currently at 7.0569 yuan) in December, and in February, it rose above the 50-month moving average (currently at 6.8855 yuan). The 200-month moving average is temporarily unavailable.

22:24

Paramount to acquire Warner Bros. Discovery at $31 per shareThe deal values Warner Bros. Discovery at 110 billions USD in enterprise value, which is equivalent to a 7.5x multiple of its projected 2026 Ebitda on a fully synergized basis. The transaction has been unanimously approved by the boards of both companies and is expected to close in the third quarter of 2026.

Trending news

MoreAccording to the latest filing submitted to the U.S. Securities and Exchange Commission (SEC), Trump Media & Technology Group has no plans to announce any dividend distribution scheme in the foreseeable future.

Analog Devices Climbs to 53rd Place in Trading Volume Driven by Robust Earnings and Key Advances in AI and Automotive Sectors

News