News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Lucid Q4 outlook: Spotlight on Gravity output and cash usage as EV manufacturer faces pivotal moment

101 finance·2026/02/24 19:36

Solana price forms sfp pattern at fibonacci support, local bottom in?

Crypto.News·2026/02/24 19:33

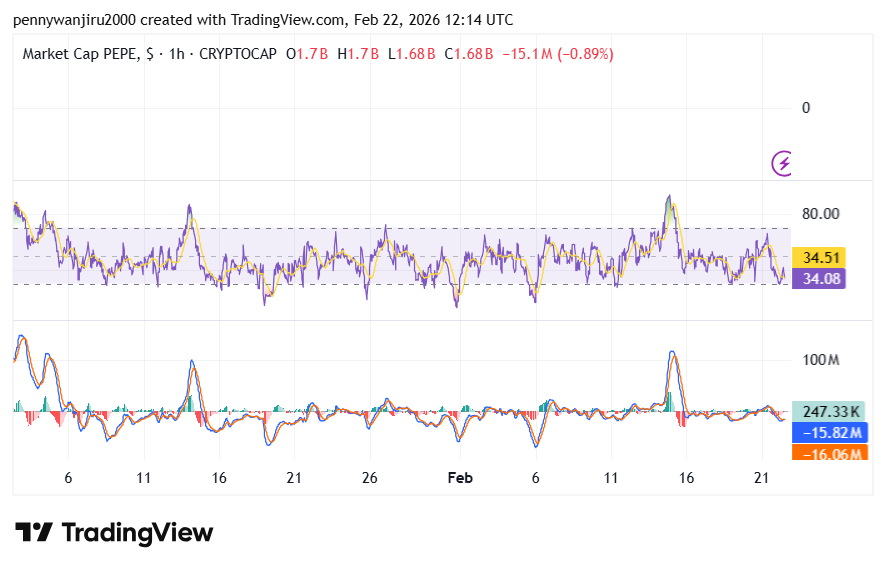

PEPE Drops 4.2% to $0.054111 as Technical Indicators Show Weak Momentum Near $0.054072 Support

Cryptonewsland·2026/02/24 19:33

Thermo Fisher Scientific Inc. (TMO) Carries a Mid-Single Digit Organic Growth Forecast

Finviz·2026/02/24 19:33

Bio-Techne Corporation (TECH) Carries Attractive FY27 Organic Growth Projections

Finviz·2026/02/24 19:30

Here's What You Must Know Ahead of PENN Entertainment's Q4 Earnings

Finviz·2026/02/24 19:21

Ten years after first cargo, US LNG dominance set to keep growing

101 finance·2026/02/24 19:21

MasTec to Report Q4 Earnings: What's in Store for the Stock?

Finviz·2026/02/24 19:18

Crypto News Today: DeepSnitch AI Eyes a Potential 100x ROI as SOL Price Remains Average

BlockchainReporter·2026/02/24 19:12

Flash

09:51

WTI Crude Oil (CONC) 2-Hour Market AnalysisThe current WTI crude oil price is showing a clear downward trend, falling from the historical high of 67.22 to 64.85, with increased intraday volatility. The resistance level is around 65.50 (based on recent highs), and the support level is at 64.80 (the intraday low). Using simple trend analysis, the price sequence indicates continued downward pressure, and it is expected that the price may test the support level of 64.80 in the future. If it breaks below this level, the decline may accelerate.

09:46

Cobo launches WaaS Skill, enabling natural language calls to WaaS 2 API to accelerate enterprise wallet integrationChainCatcher news, digital asset custody and wallet solution provider Cobo has announced the launch of Cobo WaaS Skill, enabling developers to directly call Cobo WaaS (Wallet-as-a-Service) 2 API in AI programming assistants (such as Claude Code, Cursor) using natural language, and to complete SDK code generation, debugging, and troubleshooting. This allows the construction of usable web wallet applications within 30 minutes. After installing Cobo WaaS Skill in an AI programming assistant, developers can perform operations such as creating wallets, debugging and troubleshooting, and initiating transfers through conversational interaction, while automatically generating executable SDK code. It also supports the rapid setup of basic exchange capabilities or Web3 payment processes, reducing the need to switch tools and consult documentation.

09:43

Opinion: Tether's purchase of gold is a strategic treasury decision; Bitcoin and gold can coexist as complementary assetsPANews reported on February 26 that Ivan Lee, Head of Trading at QCP Group, stated that Tether's large-scale purchase of gold is a strategic treasury decision rather than an ironic commentary on the "digital gold" narrative. Gold, as the most widely accepted non-sovereign reserve asset globally, can complement bitcoin: it reduces correlation with crypto liquidity cycles and can hedge against regulatory shocks or sudden crypto-specific tail risks such as deleveraging. Ivan pointed out that Tether has accumulated about 130 tons of gold, with its purchases in the fourth quarter of last year accounting for 10% of central bank gold demand during the same period. Bitcoin acts as a high-beta risk asset during tightening periods, while in times of monetary expansion it exhibits gold-like properties. Investors can utilize both: gold to hedge against short-term crises and liquidity pressures, and bitcoin to hedge against long-term policy risks and currency depreciation, but allocation size and risk control should be set according to their respective drawdown characteristics.