News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

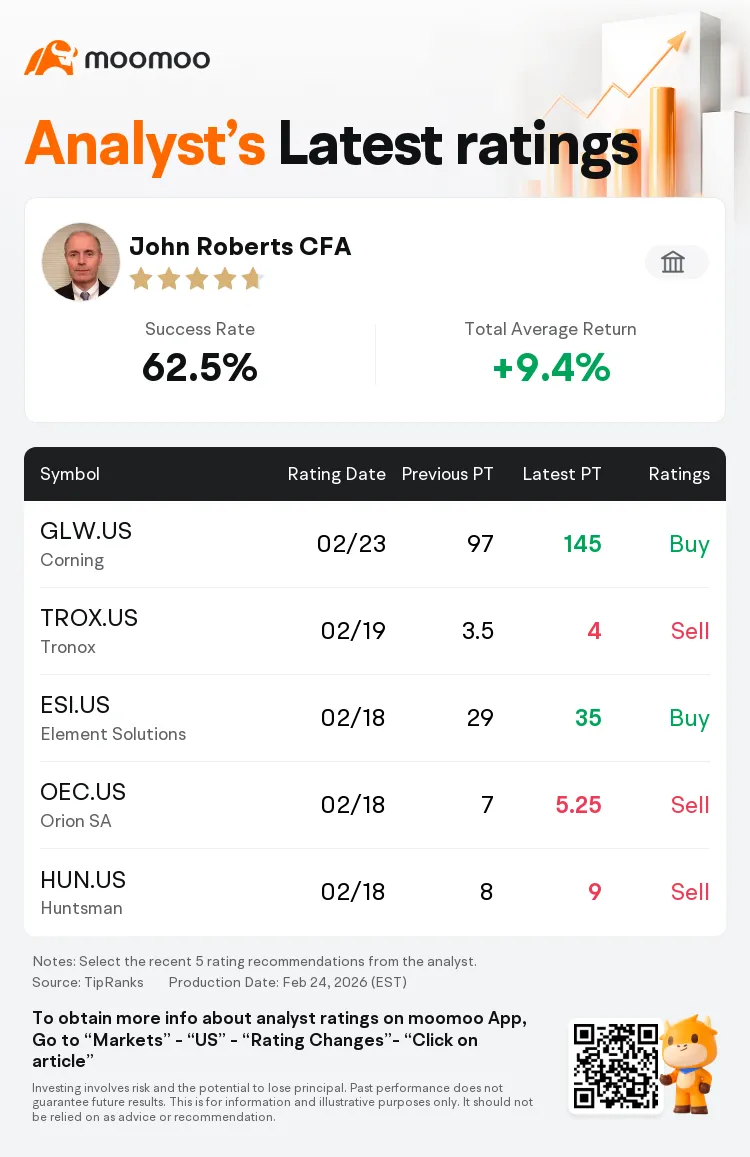

Corning Rises 5%+ Intraday to All-Time High as Mizuho Securities Boosts Price Target

moomoo-证劵·2026/02/24 18:42

Intel CEO Bets On SambaNova Partnership To Challenge Nvidia's AI Dominance

Finviz·2026/02/24 18:39

What's Going On With Ford Motor Stock Tuesday?

Finviz·2026/02/24 18:39

BNB Chain Eyes 2026 Optimization After Strong Momentum

Newsbtc·2026/02/24 18:30

Another XRP Ledger Amendment Is Coming: The Most Important Things To Know

Newsbtc·2026/02/24 18:30

Much of world economy has coped better than expected with tariffs, SNB chairman says

101 finance·2026/02/24 18:27

‘Best economic performance in history’? The statistics behind Trump’s claims

101 finance·2026/02/24 18:24

European AI chip startup Axelera raises additional $250 million

101 finance·2026/02/24 18:24

Bitcoin’s Logo Designers Shape a Global Crypto Icon

Cointurk·2026/02/24 18:21

Acurx Pharmaceuticals (ACXP) Secures New US Patent for DNA Polymerase IIIC Inhibitors

Finviz·2026/02/24 18:15

Flash

11:29

Point of View: The primary factor influencing Bitcoin's price is technical analysis, and investors need to patiently wait for the market to capitulate.BlockBeats News, February 26th, Alliance co-founder Qiao Wang posted on social media, saying that investors have spent months looking for a scapegoat for the Bitcoin bear market, including Jane Street, quantum computing, tech stock sell-off, and so on.

But ultimately, Bitcoin is an asset without cash flow anchoring, so the primary driver of its price action is only... technical analysis. And the essence of technical analysis is crowd psychology. People who believe in the four-year cycle are more than those who believe in the five-year cycle. Once the trend is broken, people start taking profits or stop-loss exits.

That's it. Most other explanations are more like correlation than causality. Now, all we have to do is wait patiently for the market psychology to fully surrender and wait for the trend to reverse. This does not necessarily require an external catalyst.

11:29

Biopharmaceutical company Soleno Therapeutics recently announced a major personnel appointmentAccording to documents submitted to the U.S. Securities and Exchange Commission (SEC) on February 25, the company has officially appointed Jennifer Fulk as Chief Financial Officer (CFO), with the appointment to take effect on March 2, 2026. This executive change marks an important step in Soleno Therapeutics' strategic planning. Jennifer Fulk has extensive experience in financial management and is expected to bring new momentum to the company's development. With the arrival of the new CFO, Soleno Therapeutics is expected to further strengthen its financial operations system, providing strong support for future business expansion.

11:22

Analyst: Indicators show that the current market sentiment is far from reaching the typical bottoming-out region of past cyclesBlockBeats News, February 26th, Cryptocurrency market analyst Axel published a report on social media stating that CryptoQuant data shows that Bitcoin's "MVRV Z-Score" is currently -2.28, dropping below the bear market bottoms of 2018 (-1.6) and 2022 (-1.4), entering a "strong bear" zone.

The MVRV Z-Score is a standardized deviation value of market value relative to realized value; a negative value indicates that the market price is below on-chain "fair value."

Axel explained that this anomaly can be attributed to the scale of realized value in the ETF era, where a large amount of institutional capital inflow has raised the cost basis, making the Z-Score more sensitive to price adjustments. If the Z-Score rebounds above -1.5 and the price holds above $65,000, it will be the first technical confirmation signal to exit the pressure zone.

However, the NUPL indicator, which measures market sentiment, is currently at 0.197, still in the "hope" zone, far from reaching the surrender zone historically seen at cycle bottoms. During a true surrender phase (December 2018, March 2020, November 2022), NUPL would drop into the negative territory, with the majority of holders experiencing net losses. The current 0.197 is in the middle of the historical range, still far from the true pain zone. The data indicates a weakening market sentiment, but not yet panic. Most participants are still in unrealized profits (NUPL> 0), but confidence has significantly wavered.