News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

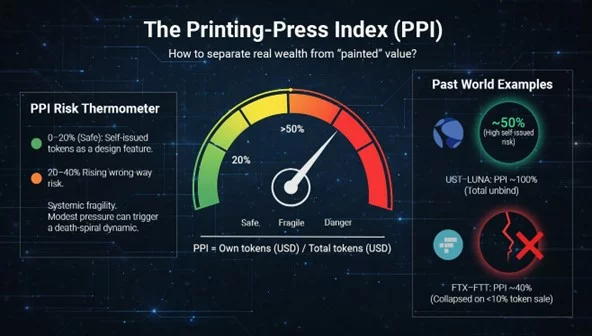

58% of Ethereum’s wealth is hiding in plain sight, and half of DeFi is built on thin air

Crypto.News·2026/02/24 18:15

Consumer optimism increased in February due to improvements in the job market

101 finance·2026/02/24 18:12

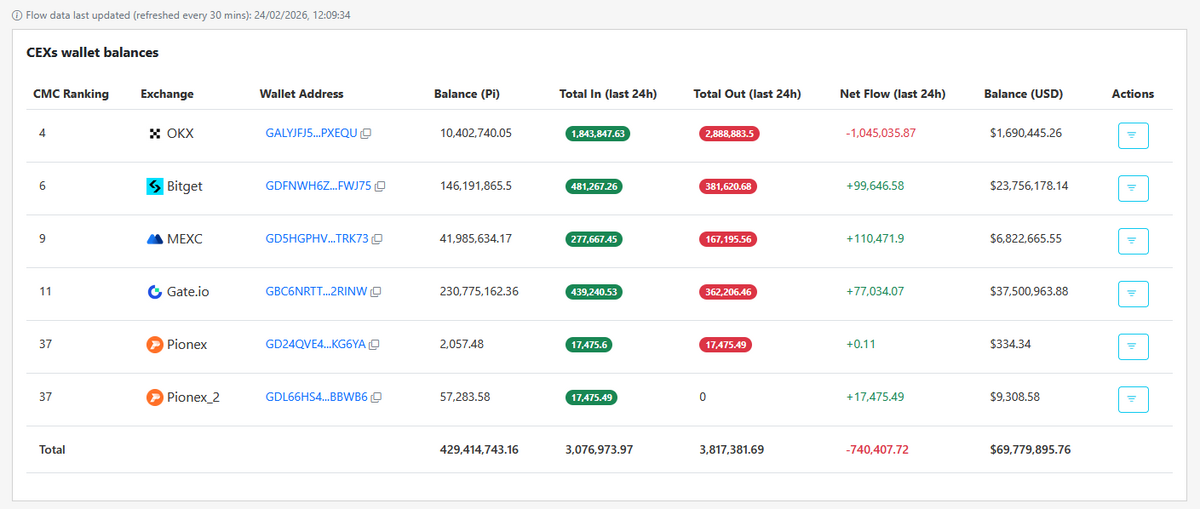

3.8 Million Pi Coins Flee CEXs Amid One-Year Anniversary

DailyCoin·2026/02/24 18:12

60 Degrees Pharmaceuticals (SXTP) Partners With GoodRx to Expand Access to ARAKODA

Finviz·2026/02/24 18:12

Tech Rebounds On AMD-Meta Deal, Software Stocks Bounce: What's Moving Markets Tuesday?

Finviz·2026/02/24 18:06

Finance Expert Says Double-Digit, Triple-Digit XRP Will Happen. Here’s why

TimesTabloid·2026/02/24 18:06

WisdomTree Receives SEC Approval to Allow Immediate Settlement for Tokenized Money Market Fund

101 finance·2026/02/24 18:01

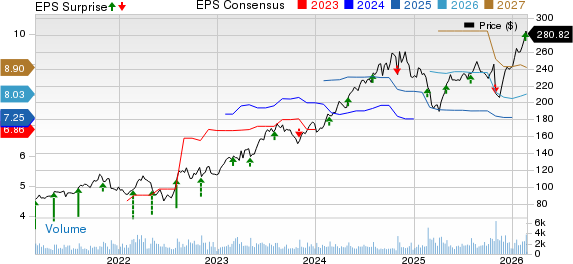

Clean Harbors Stock Barely Moves Despite Q4 Earnings and Revenue Beat

Finviz·2026/02/24 17:58

Reddit vs. Snap: Which Social Media Ad Stock Has an Edge Now?

Finviz·2026/02/24 17:58

Flash

16:47

Norwegian Sovereign Wealth Fund: AI has discovered risks overlooked by othersThe fund's AI tool is capable of identifying companies in its stock portfolio that may be involved in issues such as forced labor, corruption, or fraud, often issuing early warnings before international media reports or data providers raise alerts. The fund stated that the use of AI helps it identify and sell related investments before the broader market reacts to risks, thereby avoiding potential losses. Currently, the fund is continuously seeking new applications for AI in portfolio risk management.

16:37

The European STOXX 600 Index provisionally closed down 0.10% at 632.83 points.Eurozone STOXX 50 index provisionally closed down 0.24% at 6,158.26 points. The FTSEurofirst 300 index provisionally closed down 0.24% at 2,525.43 points.

16:37

Germany's DAX 30 Index preliminarily closed up 0.42% at 25,270.15 pointsThe French stock index closed up 0.71% in preliminary trading, the Italian stock index closed up 0.46%, the banking index closed roughly flat, and the UK stock index closed up 0.36% in preliminary trading.