News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ukraine’s entrepreneurs continue to innovate

101 finance·2026/02/24 15:57

Ripple Buying PayPal? Pundit Breaks Down Numbers & Red Tape

DailyCoin·2026/02/24 15:57

Dow Jones Industrial Average rebounds as AMD-Meta deal lifts sentiment

101 finance·2026/02/24 15:54

HBAR price risks correction to $0.07 as intraday structure turns bearish

Crypto.News·2026/02/24 15:54

Better and Framework launch $500 million credit line with stablecoin.

Portalcripto·2026/02/24 15:54

Kalshi removes affiliates from X after new promotion rules.

Portalcripto·2026/02/24 15:54

Yum China Holdings (YUMC) is a Top-Ranked Momentum Stock: Should You Buy?

Finviz·2026/02/24 15:51

Here's Why BioMarin Pharmaceutical (BMRN) is a Strong Momentum Stock

Finviz·2026/02/24 15:51

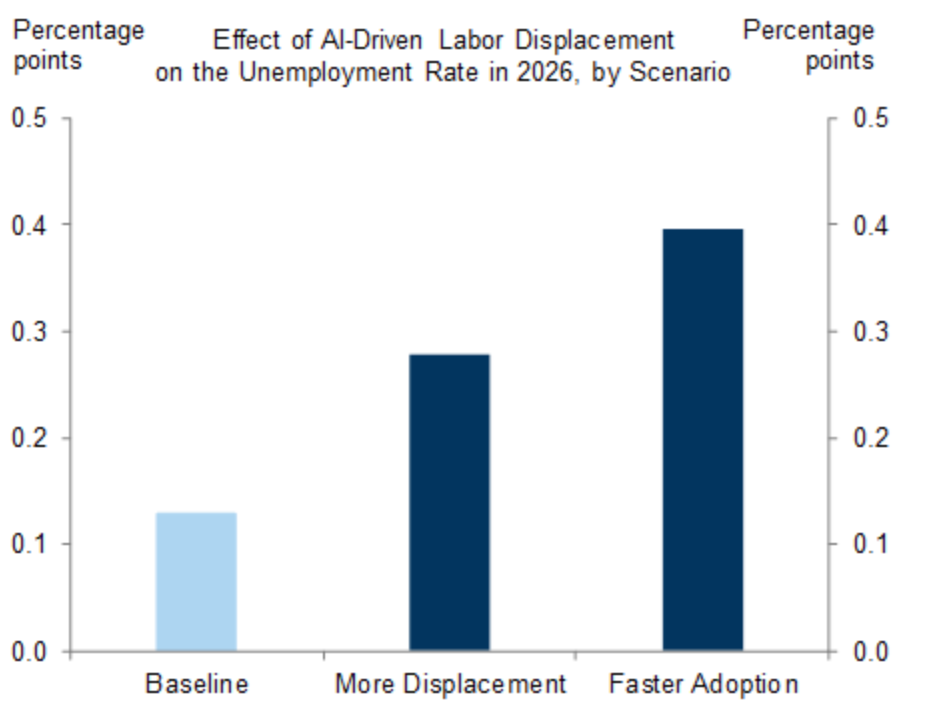

Goldman Sachs warns AI-fueled layoffs could raise the unemployment rate this year: Chart

101 finance·2026/02/24 15:45

3 Altcoins Crypto Whales Are Accumulating Amid Market Panic

Cryptonewsland·2026/02/24 15:42

Flash

16:47

Norwegian Sovereign Wealth Fund: AI has discovered risks overlooked by othersThe fund's AI tool is capable of identifying companies in its stock portfolio that may be involved in issues such as forced labor, corruption, or fraud, often issuing early warnings before international media reports or data providers raise alerts. The fund stated that the use of AI helps it identify and sell related investments before the broader market reacts to risks, thereby avoiding potential losses. Currently, the fund is continuously seeking new applications for AI in portfolio risk management.

16:37

The European STOXX 600 Index provisionally closed down 0.10% at 632.83 points.Eurozone STOXX 50 index provisionally closed down 0.24% at 6,158.26 points. The FTSEurofirst 300 index provisionally closed down 0.24% at 2,525.43 points.

16:37

Germany's DAX 30 Index preliminarily closed up 0.42% at 25,270.15 pointsThe French stock index closed up 0.71% in preliminary trading, the Italian stock index closed up 0.46%, the banking index closed roughly flat, and the UK stock index closed up 0.36% in preliminary trading.