News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitcoin vulnerable to ‘massive flush’ toward $55,000 as capital outflows accelerate, analysts warn

The Block·2026/02/24 15:21

Viking Therapeutics, Inc. (VKTX): A Bull Case Theory

Finviz·2026/02/24 15:21

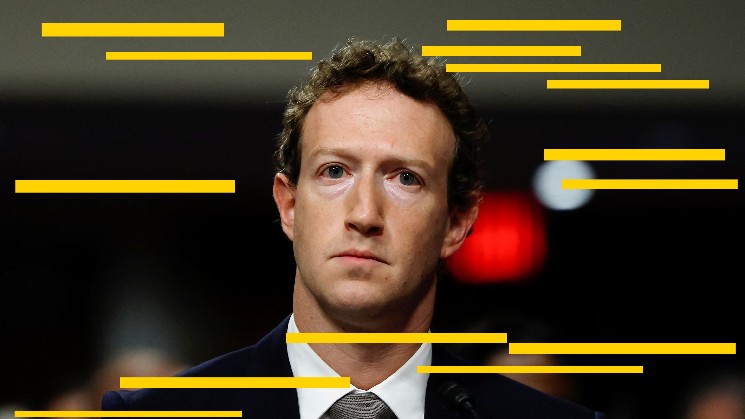

Mark Zuckerberg's Meta is planning stablecoin comeback in the second half of this year

CryptoNewsNet·2026/02/24 15:15

US consumer confidence improves modestly this month after cratering in January

101 finance·2026/02/24 15:12

Bitcoin Price News Points to Possible Rebound in 2026, but Investors Seeking 100X-300X ROI Pivot to DeepSnitch AI

BlockchainReporter·2026/02/24 15:12

US wholesale inventories up 0.2% in December

101 finance·2026/02/24 15:09

Here’s the Total Amount Top 100 XRP Whales Currently Hold

TimesTabloid·2026/02/24 15:09

US Consumer Confidence Saw a Slight Increase in February

101 finance·2026/02/24 15:03

US: Manufacturing Activity in the Fifth District Eased Slightly in February

101 finance·2026/02/24 15:03

Daktronics, Inc. to Release Third Quarter Fiscal 2026 Financial Results

Finviz·2026/02/24 15:03

Flash

18:04

FS KKR Capital Corp (ticker symbol: FSK) announced a significant reduction in its fourth-quarter dividend distribution to $0.48 per share from $0.70 per share in the third quarter, a decrease of more than 30%.This negative news quickly triggered a wave of market sell-offs, with the company's stock price plummeting by 17.6% on the day, marking the largest single-day drop in nearly a year. This dividend adjustment reflects the capital allocation pressure faced by the business development company in the current high interest rate environment. Analysts pointed out that reducing cash distributions may indicate that the company needs to retain more funds to cope with potential portfolio risks or to reserve ammunition for new investment opportunities. Although the stock price is under short-term pressure, management emphasized that this adjustment aims to strengthen the resilience of the balance sheet and lay the foundation for long-term value creation. Market participants are closely watching FS KKR Capital's subsequent asset quality reports and investment strategy adjustments. Some institutional investors believe that if the company can optimize its capital structure through this move, the current stock price correction may present an opportunity to build positions. However, more conservative investors are taking a wait-and-see approach, awaiting clearer signals regarding portfolio performance and cash flow stability.

17:38

A whale address transferred a total of 110 million H (Humanity Protocol) tokens to major exchanges, with a total value exceeding $14.3 million.According to Odaily, on-chain data shows that between February 25 and 26, 2026, a single whale address (0x1117…2de5) intensively deposited the AI identity verification Humanity Protocol token (H) into multiple centralized exchanges. The fund flows included Bitget and another exchange. On February 25, this address first transferred 2.5 million H tokens to each of the four major exchanges mentioned above, totaling 10 million tokens, valued at $1.3 million; On February 26, the address again transferred 25 million H tokens (worth $3.25 million) to each of the four major exchanges in a short period, totaling 100 millions tokens. The total value exceeded $14.3 million. Previously, from November 2025 to mid-February 2026, two other whale addresses (0x9184…6F42 and 0xbaab…7ab2) had continuously withdrawn nearly 74.4 million H tokens from centralized exchanges to accumulate on-chain. This time, however, it was a large-scale reverse deposit of 110 millions tokens into leading exchanges.

17:36

A cryptocurrency exchange has issued an announcement stating that the platform has noticed delays in the sending and receiving of Sui tokens for some users.However, the platform emphasized that users' current trading, fiat deposits and withdrawals, and other core functions are all operating normally and have not been affected by this technical issue.