News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bhutan Rolls Out Solana-Backed Visas Even As Demand Stays Weak

BeInCrypto·2026/02/24 15:00

Solana price alert: $80 Floor fails, whales track this new crypto protocol

Crypto.News·2026/02/24 14:54

USD: Squeeze risk on geopolitical escalation – OCBC

101 finance·2026/02/24 14:51

Why Prediction Markets Are Now a Strategic Issue for Brokers: KPMG

CryptoNewsNet·2026/02/24 14:51

HEICO Corporation's (HEI) Wencor Group Acquires EthosEnergy Accessories and Components

Finviz·2026/02/24 14:45

Elbit Systems (ESLT) Secures $277 Million in Contracts from Unnamed International Customer

Finviz·2026/02/24 14:45

Howmet Aerospace Inc. (HWM) Releases fiscal Q4 2025 Earnings

Finviz·2026/02/24 14:45

United Airlines selects GE Aerospace (GE)'s GEnx Engines for Boeing 787

Finviz·2026/02/24 14:45

Qualcomm, Booking Holdings receive upgrades: Leading analyst picks from Wall Street

101 finance·2026/02/24 14:45

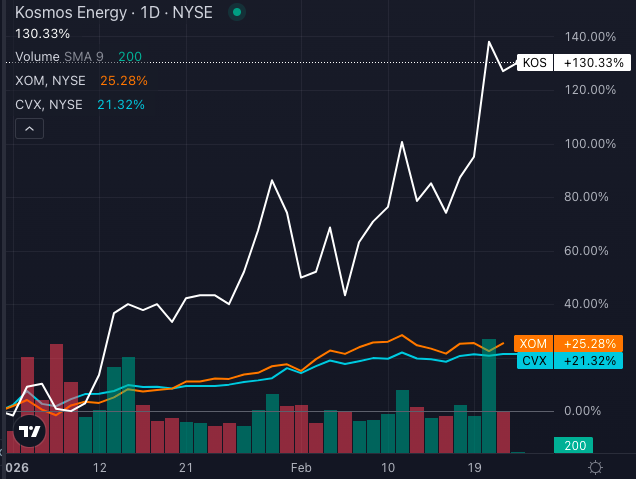

Kosmos Energy's 130% Stock Surge Leaves Exxon And Chevron Behind - But There's A Catch

Finviz·2026/02/24 14:42

Flash

11:29

Biopharmaceutical company Soleno Therapeutics recently announced a major personnel appointmentAccording to documents submitted to the U.S. Securities and Exchange Commission (SEC) on February 25, the company has officially appointed Jennifer Fulk as Chief Financial Officer (CFO), with the appointment to take effect on March 2, 2026. This executive change marks an important step in Soleno Therapeutics' strategic planning. Jennifer Fulk has extensive experience in financial management and is expected to bring new momentum to the company's development. With the arrival of the new CFO, Soleno Therapeutics is expected to further strengthen its financial operations system, providing strong support for future business expansion.

11:22

Analyst: Indicators show that the current market sentiment is far from reaching the typical bottoming-out region of past cyclesBlockBeats News, February 26th, Cryptocurrency market analyst Axel published a report on social media stating that CryptoQuant data shows that Bitcoin's "MVRV Z-Score" is currently -2.28, dropping below the bear market bottoms of 2018 (-1.6) and 2022 (-1.4), entering a "strong bear" zone.

The MVRV Z-Score is a standardized deviation value of market value relative to realized value; a negative value indicates that the market price is below on-chain "fair value."

Axel explained that this anomaly can be attributed to the scale of realized value in the ETF era, where a large amount of institutional capital inflow has raised the cost basis, making the Z-Score more sensitive to price adjustments. If the Z-Score rebounds above -1.5 and the price holds above $65,000, it will be the first technical confirmation signal to exit the pressure zone.

However, the NUPL indicator, which measures market sentiment, is currently at 0.197, still in the "hope" zone, far from reaching the surrender zone historically seen at cycle bottoms. During a true surrender phase (December 2018, March 2020, November 2022), NUPL would drop into the negative territory, with the majority of holders experiencing net losses. The current 0.197 is in the middle of the historical range, still far from the true pain zone. The data indicates a weakening market sentiment, but not yet panic. Most participants are still in unrealized profits (NUPL> 0), but confidence has significantly wavered.

11:11

Energy drink brand Celsius Holdings, Inc. recently announced its timeline for brand integration following the acquisition.The company plans to complete the full business integration of Alani Nu by the end of the first quarter of 2026, while the integration of the Rockstar Energy brand is expected to be finalized by the end of the second quarter of 2026. The clear timeline for this integration process provides the market with a transparent strategic outlook. The two acquired brands will be gradually incorporated into Celsius's existing operational system, a move that is expected to further strengthen the company's market position in the functional beverage sector. By systematically integrating resources, Celsius will optimize supply chain synergies and expand the coverage of its distribution network. Notably, the differentiated pace of integration for each brand reflects the company's precise control over the complexity of business consolidation. Alani Nu, as a health energy brand targeting female consumers, offers a product line that complements Celsius's existing portfolio; while Rockstar Energy, as a traditional energy drink giant, brings channel resources that will serve as a significant driving force for Celsius's global expansion. According to the current plan, by mid-2026, Celsius will have completed the full integration of both major brands, at which point the company's product matrix and market competitiveness are expected to achieve a qualitative leap.